Pig butchering scams are a sophisticated form of investment fraud that have made headlines around the globe. By leveraging fake online personas, scammers gradually “fatten up” their victims before “butchering” them—that is, extracting as much money as possible before disappearing with the funds. Often targeting cryptocurrency investments, these scams combine elements of romance fraud, social engineering, and high-pressure sales tactics. Understanding their modus operandi is the first step toward protecting your hard-earned money.

What Are Pig Butchering Scams?

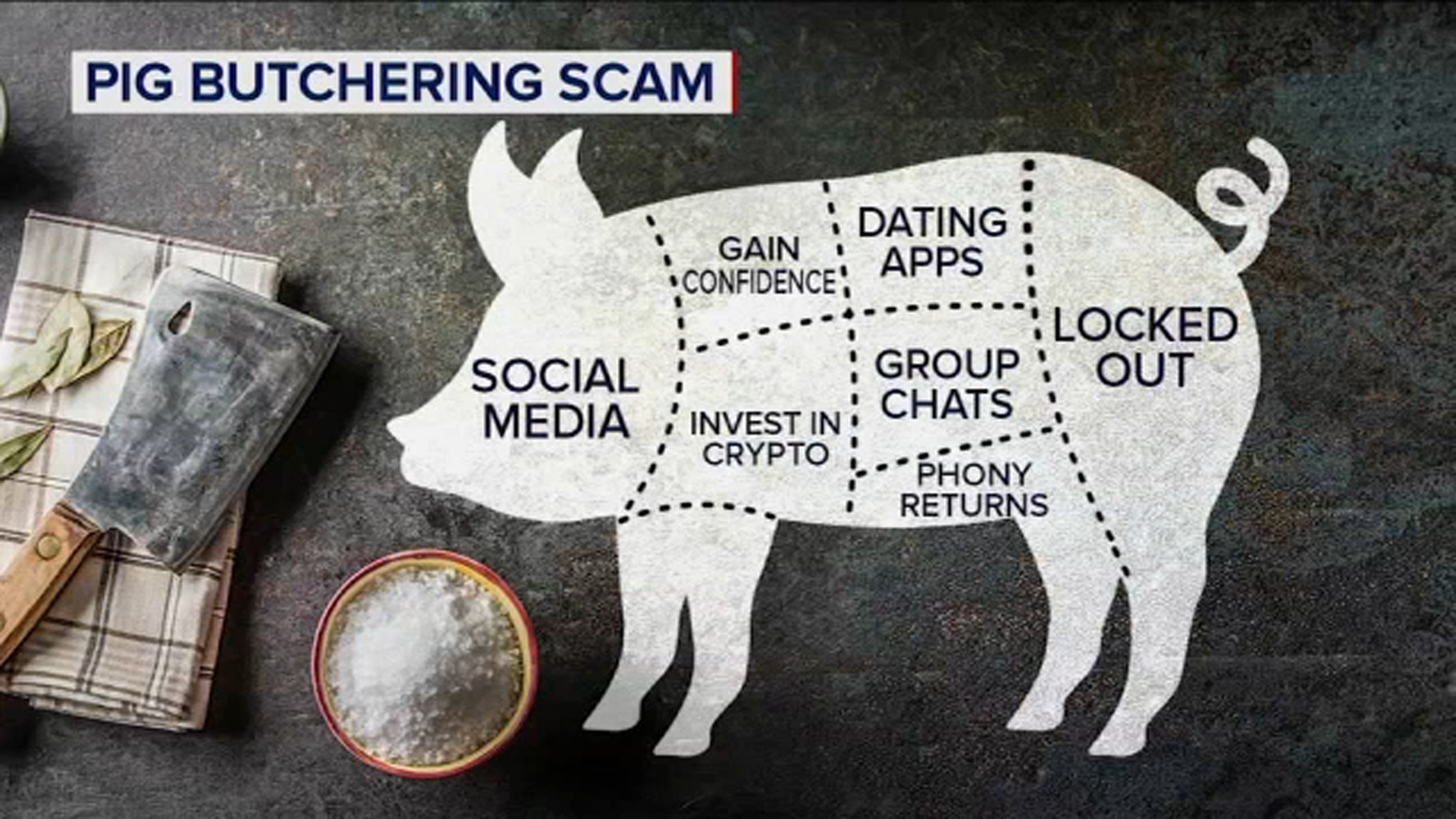

Pig butchering scams (known in Chinese as sha zhu pan) are long-term cons where fraudsters build trust with their victims over weeks or even months. Initially, they may reach out through seemingly innocent or even “accidental” messages via social media, dating apps, or text messages. Once contact is established, the scammer crafts a detailed, fake identity—often portraying themselves as a successful investor or attractive potential partner—to lure the victim into a fraudulent cryptocurrency or investment scheme.

Key points include:

- Trust Building: Scammers invest time in creating an emotional or even romantic connection.

- Fake Investment Opportunities: After gaining trust, they introduce investment opportunities that promise high returns with little to no risk.

- Gradual Escalation: Victims are encouraged to invest small amounts initially; once the scammer has “fattened” them up with minor returns, they push for larger investments.

- The Vanishing Act: Ultimately, when the victim has committed substantial funds, the scammer becomes unreachable, leaving the victim with massive financial losses.

(Learn more about the basics and history of pig butchering scams from Wikipedia

en.wikipedia.org and detailed descriptions on Stay Safe Online

How Do Pig Butchering Scams Work?

Understanding the step-by-step process of these scams can help you identify potential threats before they cause harm. The typical stages include:

- Initial Contact:

- The scam often begins with an unsolicited “wrong number” text or a message on social media or dating apps.

- The initial message might be brief and ambiguous, designed to prompt a reply.

(See examples in ProPublica’s in-depth investigation propublica.org.)

- Building a Relationship:

- The scammer uses charm, flattery, and sometimes even shared personal stories to create a sense of intimacy.

- They may send attractive profile images (often stolen or AI-generated) and create detailed fake backstories.

- Introducing the Investment:

- Once the relationship is established, the conversation shifts towards investment opportunities, particularly in cryptocurrencies.

- The scammer might present screenshots of fake trading dashboards showing impressive returns.

(Detailed processes are described in Investopedia’s breakdown of pig butchering scams investopedia.com.)

- Escalating Investments:

- Victims are gradually encouraged to invest more money. Initial small wins are used to build confidence.

- Over time, as the victim commits more funds, the scammer manipulates the conversation to justify further deposits.

- The Final Cut:

- When the victim’s account has been “fattened” sufficiently, the scammer cuts off all communication.

- Attempts to withdraw funds are met with excuses, fees, or the platform becomes inaccessible, leaving the victim defrauded.

Warning Signs: How to Spot a Pig Butchering Scam

Knowing what red flags to look for is essential. Here are several warning signs that you might be encountering a pig butchering scam:

- Unsolicited Contact:

Receiving an unexpected message or a “wrong number” text from an unknown sender can be the first step in a scam.

(See tips from Stay Safe Online staysafeonline.org.) - Overly Charming or Intimate Conversations:

If a stranger quickly moves from casual chat to an emotional or romantic relationship, proceed with caution. - Investment Focus After Building Trust:

Once personal rapport is established, a sudden pivot to discussing lucrative cryptocurrency or investment opportunities is a major red flag. - Too-Good-to-Be-True Offers:

Promises of guaranteed high returns with little or no risk are common in these scams. Legitimate investments rarely come with such assurances. - Pressure Tactics:

Scammers often create a sense of urgency, insisting that you must act quickly to avoid missing out on an opportunity. - Requests for Sensitive Information:

Be wary if you’re asked to share bank details, personal identification, or login credentials early in the relationship. - Inconsistent or Vague Details:

Watch for contradictory information about the investment opportunity or the scammer’s background.

(For more detailed red flags and examples, refer to articles by FINRA

finra.org and Secret Service advisories

How to Protect Yourself Against Pig Butchering Scams

Taking preventive measures is the best defense against these scams. Here are some crucial steps to safeguard yourself:

1. Be Skeptical of Unsolicited Contacts

- Do not respond to unexpected texts, emails, or social media messages from unknown individuals.

- If you receive a message that seems out of context (e.g., a “wrong number” text that continues after you respond), block the sender immediately.

2. Verify Identities and Profiles

- Perform reverse image searches on profile pictures to check for authenticity.

- Look for inconsistencies in the scammer’s story and verify their claims using independent sources.

3. Research Investment Opportunities

- Do your due diligence. If someone approaches you with an investment opportunity, research the platform thoroughly. Check if it is registered with legitimate financial regulators.

- Use trusted financial news sources and official regulatory sites (such as those from the SEC or FINRA) for verification.

4. Protect Your Personal and Financial Information

- Never share sensitive data such as your bank account details, Social Security number, or passwords with anyone online.

- Be cautious about oversharing on social media, which can provide scammers with valuable information.

5. Use Secure Payment Methods

- If you decide to invest, use secure, traceable methods. Avoid wiring money or transferring funds directly without verifying the legitimacy of the recipient.

6. Consult a Trusted Advisor

- Seek a second opinion from a financial advisor or a trusted friend before making any large investments.

- Professional advice can help you evaluate the risk and legitimacy of any investment proposal.

7. Stay Informed and Report Suspicious Activity

- Keep up with the latest scam alerts from reputable sources such as the FBI, Secret Service, or your local consumer protection agency.

- If you suspect you’re being targeted, report the incident immediately to law enforcement or through official channels like the FBI’s Internet Crime Complaint Center (IC3).

(For more information on protective measures, check out resources from the U.S. Secret Service

secretservice.gov and Verywell Mind’s guidelines on common scams

What to Do If You’ve Been Scammed

If you believe you have fallen victim to a pig butchering scam, take the following steps immediately:

- Cease All Communication:

Stop responding to the scammer. Do not provide any further information. - Contact Your Bank or Financial Institution:

Inform them about the fraudulent activity. Request that any further transactions be halted. - Report the Scam:

- File a report with local law enforcement.

- Submit a complaint through the FBI’s Internet Crime Complaint Center (IC3).

- Consider contacting consumer protection agencies in your country.

- Gather Evidence:

Keep records of all communications (screenshots, emails, texts) as they can be crucial for investigations. - Seek Professional Help:

Consider consulting a lawyer or a fraud recovery specialist to explore potential options for recovering lost funds.

Conclusion

Pig butchering scams are a growing threat in today’s digital economy, blending romance, trust, and fraudulent investment schemes to steal large sums of money. By understanding how these scams operate, recognizing the red flags, and taking proactive steps to protect your personal and financial information, you can reduce your risk of becoming a victim. Always remain cautious of unsolicited contacts and thoroughly verify any investment opportunities before committing your funds.

Stay vigilant, do your research, and if something feels off, trust your instincts—report it immediately.

Frequently Asked Questions (FAQ)

Q: What is a pig butchering scam?

A: It is a long-term con in which scammers build trust with victims and gradually lure them into investing in fraudulent schemes, often involving cryptocurrency, before disappearing with the funds.

Q: How can I spot a pig butchering scam?

A: Key red flags include unsolicited messages, overly rapid relationship-building, promises of high returns with minimal risk, pressure to invest quickly, and requests for sensitive financial information.

Q: What should I do if I suspect I’m being scammed?

A: Stop all communication immediately, contact your bank to secure your accounts, gather and preserve all evidence, and report the scam to local law enforcement and through official channels like the FBI’s IC3.

Q: Can pig butchering scams be prevented?

A: While no method is foolproof, staying informed about common tactics, verifying identities, protecting personal information, and seeking professional advice can significantly reduce your risk.